extended child tax credit 2022

With six advance monthly child tax credit checks sent out last year only one payment is left. A number of recent articles have suggested that the expanded child tax credit provided in 2021 has now expired.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Dont Miss Out on an Extra 1800 Per Kid This Tax Season.

. How the Extended Child Tax Credit Could Make a Comeback. The good news is. The Build Back Better Act would not only extend full refundability to the 2022 child tax credit but it would make the credit fully refundable on a permanent basis.

The Child Tax Credit has been extended until the end of 2022 and further changes should help some of Americas poorest families. The 2022 plan also includes permanent refundability for the Child. January 26 2022.

In 2021 and 2022 the average family will receive 5086in coronavirus stimulus money thanks to the expanded child tax credit. This final installment which arrives with your tax refund after you file your. January 31 2022.

Without the passage of the Build Back Better act the enhanced child tax credit CTC reverts to what it was pre-2021. Heres What to Know. For one thing its value increased from a maximum of 2000 in 2020 to a maximum of 3000 in 2021 for children.

Oli Povey Olabolob Update. Will Child Tax Credit Payments Be Extended in 2022. However Congress had to vote to extend the payments past 2021.

Therefore child tax credit payments will NOT continue in 2022. More enhanced child tax credit money is coming this year. Manchin proposed work requirements for families that receive the expanded child tax credit and he has signaled his desire to lower the income threshold.

2 days agoHow to receive CTC faster in 2022. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. Enhanced child tax credit payments which give checks to families worth up to 1800 per child are set to end in.

An earlier version of Democrats legislation originally pegged at 35 trillion would have extended the enhanced child tax credit value through 2025 instead of 2022. This money was authorized by the American. Up to 2000 per eligible child under 17 in the form of an.

However that only applies to the monthly. Under the BBB spending plan the current expanded Child Tax Credit will be extended for another year bringing the total amount paid over 2 years to a maximum of. Learn how to get half or more of it.

Last year the Child Tax Credit got some important enhancements. The child tax credit isnt going away. In 2021 the CTC increased from 2000 per child under the age of 18 to 3000 per child and 3600 children younger.

The framework calls for a continued 300 per month for every child under six and 250 per month for every child ages 6 to 17. The credit is designed to reduce taxpayers tax liability. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less.

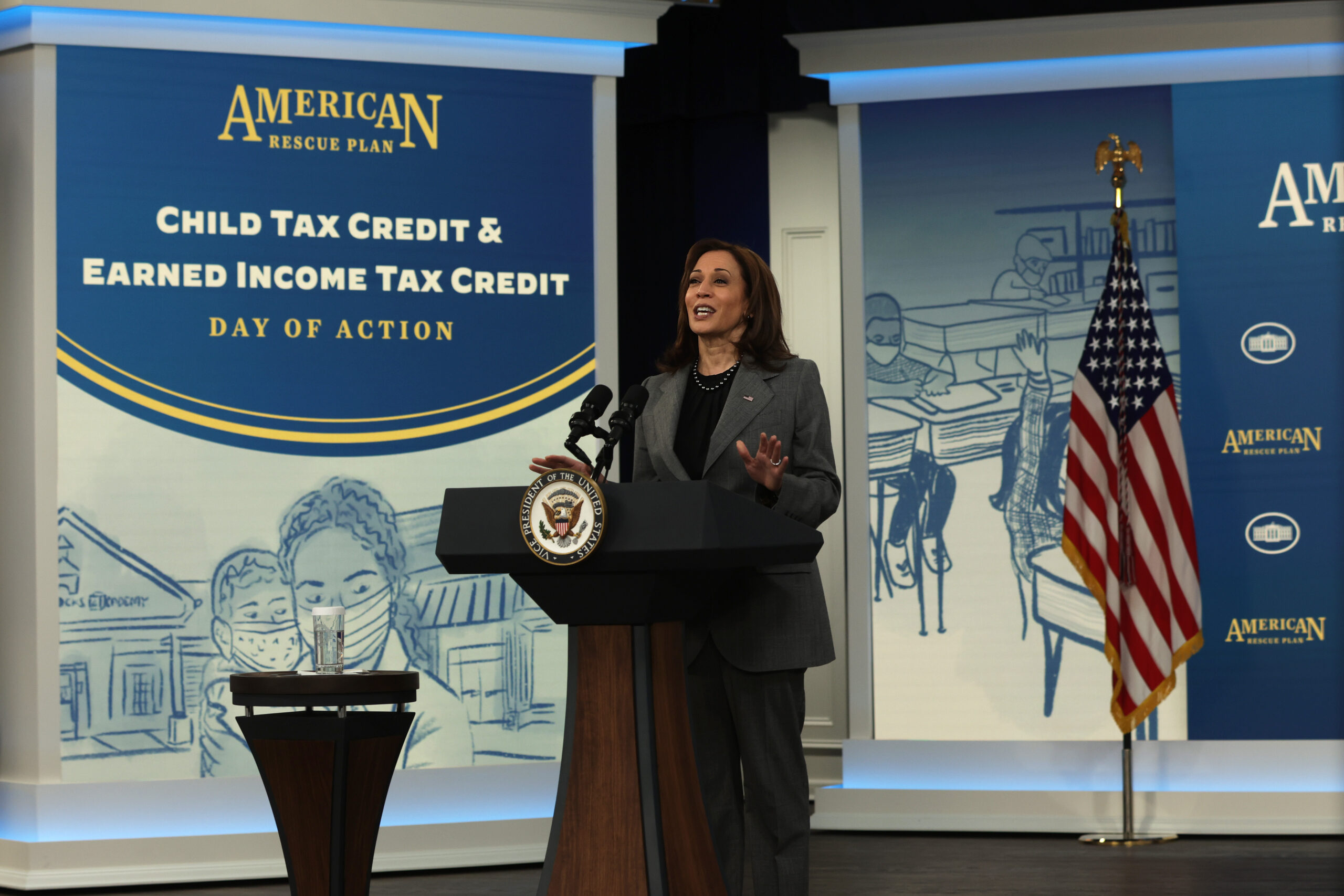

Tax season 2022 officially began on Monday January 24 allowing individuals to receive extra money from the extended child tax credit. In January the Biden administrations one.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How Can You Still Get 1800 In 2022 Despite Checks Being Over Marca

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Parents Guide To The Child Tax Credit Nextadvisor With Time

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times